Estimated 2026 Basic Allowance for Subsistence (BAS) rates help you plan take-home pay before official tables post. Using the 2026 baseline and typical food-cost adjustments, enlisted BAS is often projected around $480–$485 per month, with officer BAS around $330–$335. Treat these figures as planning ranges until official rates are published and reflected on your LES.

Estimated rate ranges for 2026

- Enlisted BAS is commonly estimated near the low-$480s monthly when applying a modest food-cost index change to the baseline.

- Officer BAS is often projected near the low-$330s monthly, reflecting the same index approach on a lower starting rate.

- BAS II, if authorized, is typically twice the standard enlisted BAS and can shift meal budgeting far more than minor raises.

- These ranges are planning numbers only; the published rate on your LES is the one that drives your paycheck.

Why BAS changes can differ from basic pay

- BAS changes track USDA food costs, which can move differently than wages used for the annual basic pay raise.

- Eligibility rules matter: training statuses, government meals, and meal collections can change the net value you see monthly.

- Overseas allowances like OHA and COLA can be larger variables than BAS, so treat BAS as one line in a full pay plan.

Top questions about estimated 2026 BAS

Can BAS rates vary by pay grade?

Standard BAS does not vary by pay grade. Officers share one monthly BAS rate and enlisted members share one standard rate. The exceptions are special situations like BAS II or periods when BAS is restricted, such as initial entry training or certain government meal arrangements. Your LES will show the rate and any collections.

What other allowances are available to service members stationed overseas?

Overseas Service members may be eligible for housing reimbursements like Overseas Housing Allowance, cost-of-living allowances that reflect local prices, and temporary lodging allowances during certain move windows. Travel per diem and dislocation allowances can also apply. The exact mix depends on orders, accompanied status, and whether government housing is available.

What is the history of the Basic Allowance for Subsistence?

BAS began as part of the Military tradition of providing rations, then evolved into a cash allowance. Modern rules tie BAS to food-cost measures rather than wages, and reforms shifted enlisted members to receiving full BAS while paying for meals. That structure explains both small annual increases and occasional larger jumps.

Key Takeaways

- Estimated 2026 BAS ranges help budget, but DFAS publishes the only official rates annually.

- Using 2026 baselines, a 3–4% food-cost change suggests low-$480s enlisted BAS for planning purposes.

- Officer BAS is typically lower, so the same percentage increase yields a smaller dollar change.

- Standard BAS does not vary by pay grade, but BAS II can apply in rare cases.

- Overseas entitlements like OHA, COLA, and TLA may matter more than BAS for housing moves.

- Track your LES and meal deductions to confirm the allowance you receive matches your entitlement status.

What are the estimated 2026 BAS rates for enlisted and officers?

A reasonable estimate puts 2026 enlisted BAS around $480–$485 and officer BAS around $330–$335 monthly. Treat it as a budget range, not a final entitlement.

The Department of Defense explains BAS and posts the current baseline on its Military Compensation BAS page.

BAS moves with food costs, so the final percentage can differ from the annual basic pay raise.

- The 2026 BAS baseline is $465.77 for enlisted and $320.78 for officers, so any 2026 estimate should start there first.

- BAS II is a separate enlisted-only entitlement and is set at twice standard enlisted BAS, which materially changes the planning range.

- Even when BAS increases, a member may see meal collections or dining facility charges that offset some of the cash benefit.

- Pull the BAS line from your most recent LES and record whether it shows standard enlisted, officer, or BAS II.

- Apply a simple multiplier like 1.03 to 1.04 to the baseline amount, keeping cents for a closer estimate comparison.

- Build a buffer for rounding, tax effects, and any dining facility collections, then adjust once the official rate posts publicly.

If you need a single planning number, select the midpoint of your estimate band and keep the low and high as guardrails.

This keeps the plan executable while maintaining situational awareness. For example, a 3.5% planning assumption lands close to

the low-$480s for enlisted BAS, while a 4% assumption lands slightly higher. The spread is small, but disciplined budgeting avoids surprises.

Explore More Military Pay & Budgeting Resources

Want to take full control of your finances and military pay schedule? These in-depth guides walk you through everything from LES statements to early direct deposit tips, budgeting strategies, and how pay aligns with holidays.

- 2026 USAA Military Pay Dates – Plan your finances with USAA’s early deposit schedule and updated pay calendar.

- 2026 Navy Federal Military Pay Dates – See how NFCU processes military deposits around federal holidays and weekends.

- USAA vs. Navy Federal: Early Pay Comparison – Compare timing, reliability, and features of both military-friendly banks.

- Federal Holidays That Affect Military Pay – Stay ahead of pay disruptions with this holiday calendar and planning guide.

- How to Set Up USAA Military Direct Deposit – Step-by-step instructions to get paid faster with USAA.

- Navy Federal Direct Deposit Setup for Military Pay – Ensure accurate deposit setup with this NFCU-specific guide.

- Budgeting Tips for Military Families with Biweekly Pay – Learn how to budget around early pay dates, PCS moves, and variable income.

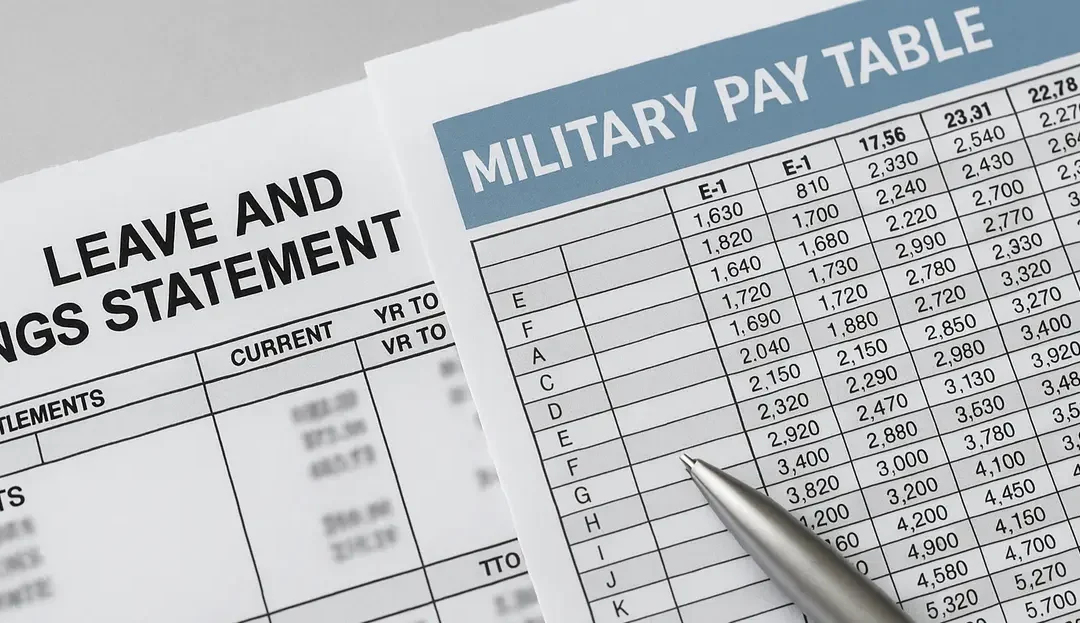

- How to Read and Understand Your LES – Break down every section of your Leave and Earnings Statement for smarter money management.

- 2026 BAH Rates by Rank and Location – Review updated Basic Allowance for Housing (BAH) charts to estimate your monthly housing benefit.

- Using Military Pay to Qualify for a VA Loan – Learn how lenders evaluate LES, BAH, BAS, and ETS dates when approving VA loans.

How does the government calculate BAS each year?

BAS is tied to food costs, not wages. It is adjusted annually using USDA food-cost data.

Federal law in 37 U.S.C. § 402 ties the allowance to USDA food plan costs and directs annual adjustments.

That structure helps explain why BAS can rise quickly in high-inflation periods and move more slowly when food prices cool.

- The law links BAS to USDA food plan costs, so food inflation can drive BAS higher even when wage growth slows.

- Because BAS is a standard allowance, you do not need to be married or have dependents to receive it if eligible.

- Annual adjustments are mechanical, so large shifts usually signal a real change in measured food costs, not a policy error.

- Track the baseline BAS from DFAS and note the year-to-year percent changes, which help you bound reasonable estimate ranges quickly.

- Watch for official DoD messaging on how BAS is indexed, since those explanations clarify why BAS may diverge from basic pay.

- When rates publish, confirm your LES matches your eligibility status, and raise discrepancies through your finance office immediately in writing.

Operationally, the key takeaway is that BAS is not designed to mirror the basic pay raise. If your budget plan assumes “all pay goes up together,”

you will periodically be wrong. A better approach is to treat BAS as its own line, tied to food-cost conditions, and update it independently when

official tables publish.

Can BAS rates vary by pay grade or duty location?

Standard BAS is flat, so it does not change by pay grade or duty location. Eligibility can still change with training, quarters, or meal collections.

The Department of Defense details these conditions in DoD Financial Management Regulation, Volume 7A, Chapter 25.

That guidance covers the single officer rate, the standard enlisted rate, and special cases like BAS II.

- Standard BAS does not scale with rank, so an E-3 and an E-9 generally see the same enlisted BAS rate.

- BAS eligibility can be restricted during initial training, certain leave statuses, or when pay is forfeited, so timing matters operationally.

- If you are on a meal card or subject to mandatory meal collections, you may still receive BAS but repay meals through deductions.

- Identify your current status: training pipeline, ship or field environment, government quarters, and whether meals are provided in kind today.

- Check your LES for the BAS type label and any meal collection line items, then compare that to what your command authorized.

- If you think you qualify for BAS II, gather written documentation about quarters and mess availability, and route it through your admin chain.

For accountability, treat BAS disputes like any other pay discrepancy: establish the firm baseline (orders, status, quarters, and mess availability),

then cross-check the LES line items. If the entitlement is right but collections are wrong, the fix may be in the collection mechanism rather than the BAS rate itself.

How can you build a solid estimate for 2026 BAS from 2026 data?

You can build a dependable estimate by starting with the official 2026 BAS values and applying a reasonable index range. Keep the math simple and document your assumption.

DFAS posts the baseline BAS table with effective dates on its BAS rate table.

Use it to confirm the current officer and enlisted amounts, and remember BAS II is defined as twice standard enlisted BAS.

- Use a 3–4% adjustment band when making an estimate, because that range historically covers both calm years and moderate inflation years.

- Calculate both the standard BAS and BAS II amounts if BAS II is plausible for your situation, since it is a straight double.

- Keep the estimate separate from basic pay, BAH, and taxes, so you can update only one variable when the final rate changes.

- Start with the current DFAS BAS amount for your category and write down the effective date you are using as your baseline.

- Pick an assumption (for example, 3.5%) and multiply the baseline by 1.035, then round to the cent for a clean worksheet.

- Repeat for a low and high scenario, then brief your household on the range so expectations stay aligned until official numbers publish.

| Assumed adjustment | Enlisted BAS estimate | Officer BAS estimate | Enlisted BAS II estimate |

|---|---|---|---|

| 3.0% | $479.74 | $330.40 | $959.49 |

| 3.5% | $482.07 | $332.01 | $964.14 |

| 4.0% | $484.40 | $333.61 | $968.80 |

These scenarios are illustrative planning math, not official entitlements. The purpose is to keep your budget agile by bracketing outcomes.

Once DFAS publishes the official rate, update the worksheet and reconcile it against your LES. That disciplined “estimate, verify, correct” loop keeps you off the back foot.

What other allowances are available to Service members stationed overseas?

Overseas pay planning typically hinges on housing and cost-of-living entitlements, not BAS. BAS remains a standard monthly allowance, but other lines can dwarf it.

The DoD Travel allowances program explains OHA and its components on the Overseas Housing Allowance page.

Use that baseline to map housing reimbursements, then layer in other overseas entitlements and one-time move costs.

- OHA is a reimbursement-style housing entitlement overseas, so it can vary widely by location, rent, utilities, and approved ceilings monthly.

- Overseas COLA is meant to offset higher day-to-day costs overseas, and it can change when exchange rates or surveys move.

- Temporary lodging allowances, dislocation allowances, and travel per diem often become the critical path during PCS moves, especially at arrival and departure.

- Confirm your accompanied status and housing plan early, because that decision gates whether you draw government quarters, OHA, or a mix.

- Build a checklist of documents that finance typically requires, such as lease, utility agreements, and arrival paperwork, and keep copies.

- After the first overseas LES posts, reconcile each allowance line with your orders and receipts, and push corrections quickly through channels.

For official definitions and rate mechanics, cross-check the Overseas Cost-of-Living Allowance page before you lock your budget.

Overseas COLA is a variable allowance tied to measured costs and exchange rates, so treat it as a shifting input rather than guaranteed monthly income.

What is the historical trend of BAS rate changes?

BAS changes usually track food inflation, so increases can be small in calm years and sharp during spikes. Some years include sharp jumps.

An official Air Force news release documented the large BAS increase effective Jan. 1, 2023 on Wright-Patterson Air Force Base’s site.

When you review recent DFAS BAS history, you can see how quickly the allowance responded to food-price pressure.

- Recent BAS history shows low single-digit increases in several years, with a pronounced jump when food inflation accelerated nationally measurably.

- Because BAS is index-driven, the trend is smoother than rent-based allowances, but it can still move quickly when the underlying index changes.

- Using multi-year tables helps you avoid mission creep in budgeting; you plan for ranges instead of betting on a single point estimate.

- Plot the last several BAS increases and compare them to observed food inflation, which keeps your assumption grounded and defensible.

- If you see a year with an outlier jump, review what drove food prices, then decide whether to use a wider planning band for estimates.

- Once the official rate is published, update your worksheet, then do a quick after-action review to improve next year’s estimate process.

| Effective date | Enlisted BAS | Officer BAS | Approx. year-to-year change |

|---|---|---|---|

| Jan. 1, 2020 | $372.71 | $256.68 | Baseline reference point |

| Jan. 1, 2021 | $386.50 | $266.18 | About 3.7% increase |

| Jan. 1, 2022 | $406.98 | $280.29 | About 5.3% increase |

| Jan. 1, 2023 | $452.56 | $311.68 | About 11.2% increase |

| Jan. 1, 2024 | $460.25 | $316.98 | About 1.7% increase |

| Jan. 1, 2026 | $465.77 | $320.78 | About 1.2% increase |

The trend shows why a single “standard” assumption can fail in either direction. In normal conditions, low single-digit planning is reasonable.

In periods of rapid food inflation, the index can drive a larger adjustment. For readiness, the practical method is to budget with a range, then update

immediately when the published rate becomes available.

The bottom line

BAS is a standard allowance intended to offset a portion of a Service member’s meal costs. Because it is indexed to USDA food costs, the annual change can differ from the basic pay raise.

For planning, a common approach is to take the current DFAS baseline and apply a conservative band, such as 3–4%, which points to enlisted BAS in the low-$480s and officer BAS in the low-$330s.

Your actual entitlement can still change based on training status, government meals, or rare situations like BAS II. The cleanest way to maintain situational awareness is to track the BAS line on your LES,

document your assumptions, and update your budget once the official rates post and your pay account reflects them.

References Used

- Military Compensation and Financial Readiness: BAS overview and baseline rates

- DFAS: BAS rate table by effective date

- U.S. Code: 37 U.S.C. § 402 (Basic allowance for subsistence)

- DoD FMR Volume 7A, Chapter 25: Subsistence and Basic Needs Allowances

- DoD Travel: Overseas Housing Allowance (OHA)

- DoD Travel: Overseas Cost-of-Living Allowance (COLA)

- Wright-Patterson AFB: Historic BAS increase background

Frequently Asked Questions

When will the official 2026 BAS rates be published?

DFAS publishes BAS rates annually, typically ahead of the January 1 effective date. If you are budgeting early, use an estimate band, then confirm the official rate on DFAS and verify it appears on your next LES.

Is BAS taxable income?

In most cases, BAS is a nontaxable allowance paid to eligible Service members. Your LES separates allowances from taxable wages, so you can verify how it is treated for withholding and year-end tax documents.

Does BAS increase if you have dependents?

No. BAS is intended to offset the member’s food costs, not family meals. Dependency status affects other entitlements like BAH or OHA, but BAS remains the same standard rate for your category if eligible.

What is BAS II and who might qualify?

BAS II is an enlisted-only rate set at twice standard enlisted BAS. It may apply when an enlisted member is assigned to certain government quarters without adequate cooking facilities and a government mess is unavailable, subject to approval.

Can you receive BAS while on leave or TDY?

Many Service members continue to receive standard BAS during authorized leave and most travel statuses, but special cases exist. If you normally receive BAS II, you may revert to standard BAS during travel or hospitalization.

Why can BAS change differently than the annual basic pay raise?

Basic pay raises are typically tied to wage-growth metrics, while BAS adjusts based on food cost measures. When food inflation runs hot, BAS can increase faster; when food prices cool, BAS may rise slowly.

How do meal deductions affect the value of BAS?

BAS is paid as an allowance, but the government can collect money for meals provided, depending on your situation. Those collections show on your LES and can reduce your take-home cash even when BAS increases.

What is the best way to budget with estimated BAS rates?

Use a range, not a single number. Keep your worksheet with a low and high scenario, then update as soon as the official rate is posted and reflected on your LES. This avoids surprises.

Do Reserve and Guard members receive BAS?

Eligibility for BAS depends on duty status. In general, BAS is associated with periods of active duty where basic pay applies, and it may not be paid for short drill periods. Check your component’s finance guidance.

Where can you see BAS on your pay documents?

BAS appears on your Leave and Earnings Statement as an allowance line item. If you are subject to meal collections, you may also see separate deduction or debt lines. Those two lines together explain your net change.

Levi Rodgers is the Founder of VA Loan Network, a leading resource for Veteran homebuyer education. A Retired Green Beret and Broker-Owner of LRG Realty in San Antonio, Levi leverages his military discipline and real-world real estate expertise to provide Veterans with expert loan advice, guidance, and trusted financial leadership.